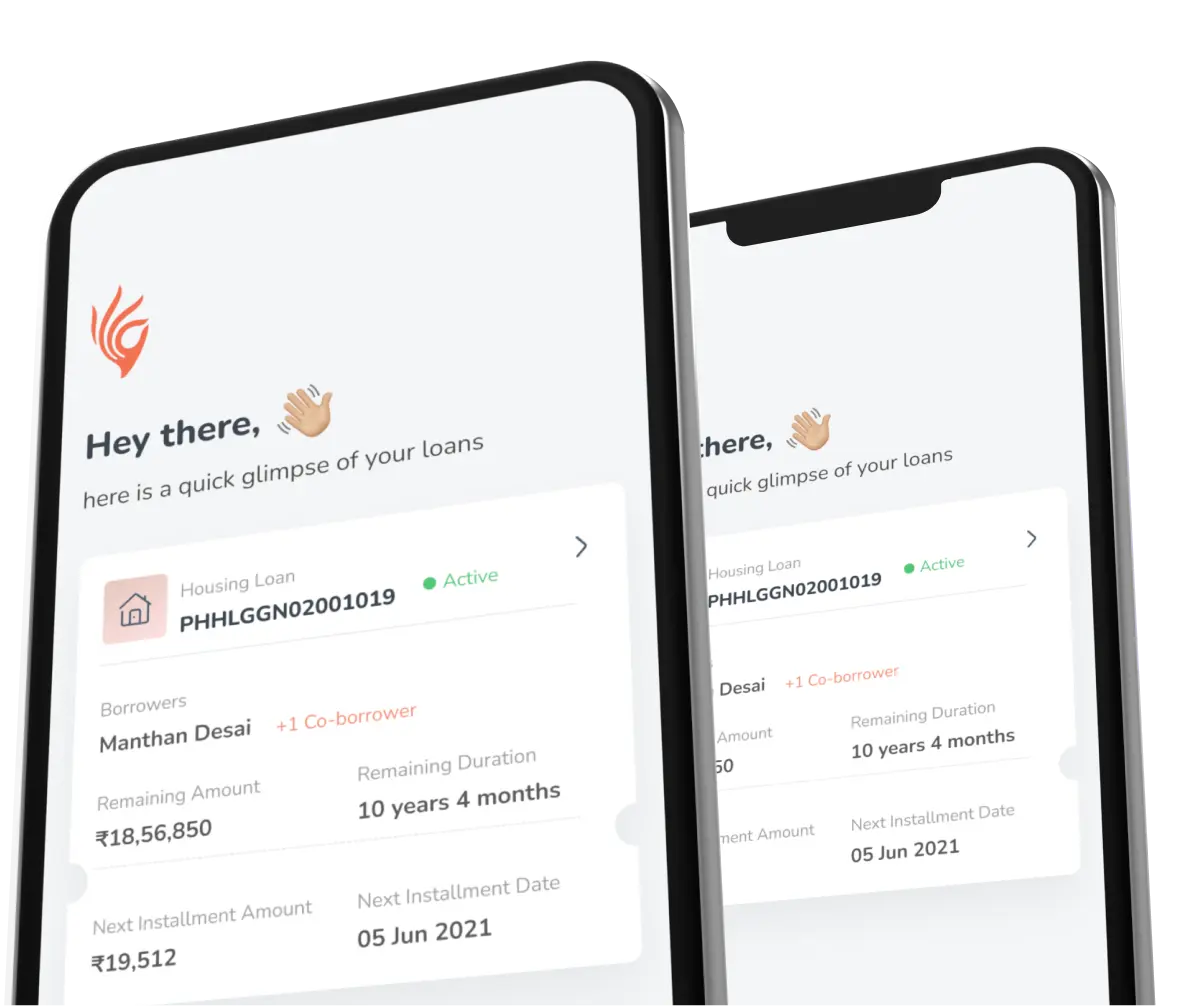

In retail lending, we offer multiple products, including home loans, loan against property, loan against Mutual Funds, used car loans, small business loans to Indian budget conscious customers of Bharat.

Loan Against Securities (LAS)

At Piramal Enterprises Limited, we provide Loan Against Securities to eligible clients. The acceptable securities are Open Ended Mutual Funds, Equity Shares, and other acceptable securities etc. It is a Flexi Loan – Disbursement in one or more tranche(s) which enables customers to withdraw money as per their requirement. Interest is charged only on utilized amount for the period of utilization.

FAQs

LAS Product will help you to meet your Personal/ Business needs without liquidating your investments. You can raise funds instantly in case of any emergency.

LAS Product is offered to Individuals (Only Resident Indians).

- Salaried

- Self-Employed Professionals

- Self-Employed Non-Professionals

Customers can avail minimum Loan Amount of Rs 50,000 (50K) and Maximum upto Rs 5 Crores

Loan Tenure is upto 1 year. Customer can further Renew Loan facility upto 2 times for 1 year each.

Minimum age limit to avail LAS facility is 21 years.

- Interest is calculated on the basis of daily outstanding balance and debited into Loan account on the last day of the month.

- Interest is charged on amount used and for the period it is used.

- Interest needs to be paid on or before 5th day of following month.

- A monthly notification shall be sent to Customer informing about the interest due. Interest will be collected through ECS. (Currently we do-not accept repayment by cheque).

- Interest to be serviced monthly and Principal as a bullet repayment at the end of loan tenor.

Customer can withdraw and repay loan at any time. There are no charges for any early payments.

Yes. Customers doesn’t need to have any prior relationship with Piramal, to open LAS Account.

Client can Lien / Pledge any number of Mutual Fund Schemes / Shares. Limit will be provided against approved securities only. Also, client to note the charges of Lien / Pledge Release.

Yes, client can Un-lien his mutual funds (up to excess margin) by requesting Piramal Enterprise Ltd.

To view the charges associated with loan account, Click here.

* Note: The ROI / PF and other charges may varies at me of loan account opening at discreon on lender